Ethereum Unlikely To Hit ATH In 2024, 85% Polymarket Traders

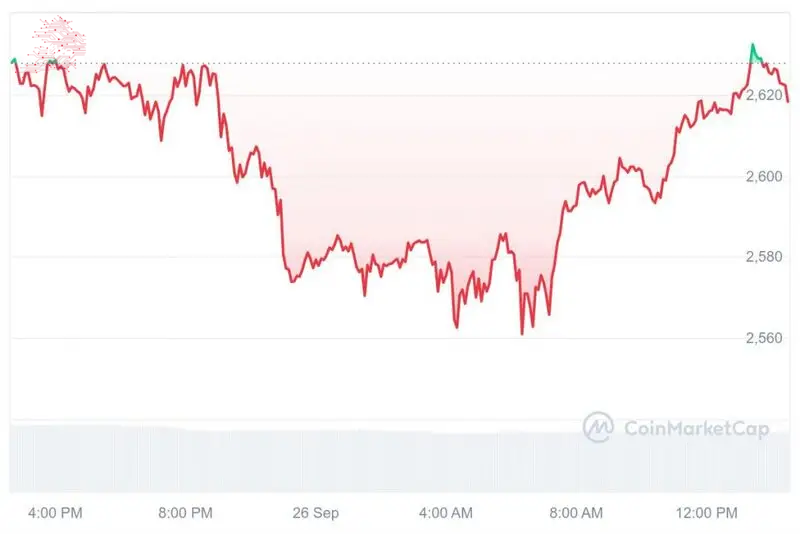

The Ethereum (ETH) network has witnessed more downs than ups over the past few months. Despite its 64% ascent over the last year, ETH failed to hit an all-time high of $4,891.70. At press time, ETH was trading at $2,615.78 following a dainty drop over the day. Considering its current price, the altcoin is 46% below this level.

Also Read: Can Bitcoin (BTC) Surge To A High of $80K In ‘Uptober’ Rally?

ETH holders took to CoinMarketCap to reveal their expectations about the asset. Out of 97071 votes, only 26% of the community were bullish about Ethereum’s potential rise. A staggering 74% were bearish about the altcoin. It looks like this was the common notion in the ETH market.

Also Read: Digital Currency: Hong Kong’s CBDC Pilot Testing Enters Phase 2

Bearish Sentiment Reigns The Ethereum Market

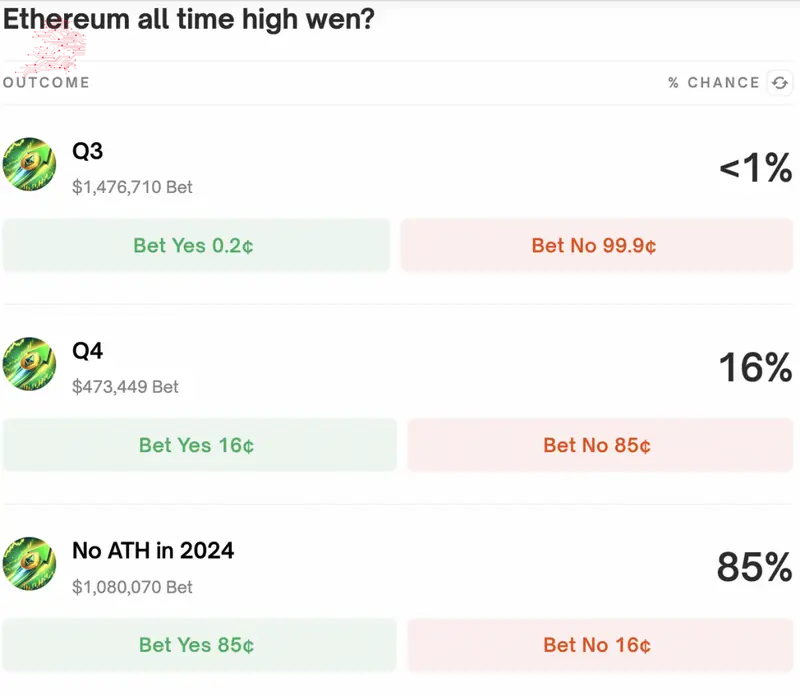

Data from Polymarket, a prominent prediction platform, reveals that there is currently an 85% chance that Ether will fail to reach a new all-time high in 2024. Just last week, the percentage was at 71%. A dainty 14% of bettors anticipated a new ATH. In addition, fewer than 1% had irrational expectations for a new peak in the coming five days.

This wasn’t all, as the $1.23 million total bet made by the 1% of traders who anticipated a Q3 ATH was more than the $1.07 million wager made by the 85% of traders who said there would be no ATH in 2024.

This sudden pessimism comes from a regulatory move from the United States. The US Securities and Exchange Commission (SEC) stated in a document that it would postpone approving options trading for spot Ethereum ETFs. While this did not have a major impact on its price, it did bring down the spirits of Ethereum investors.

Also Read: Ripple (XRP) & DogWifHat (WIF) Price Prediction For October 2024

Comments

Post a Comment