Bitcoin payments nosedive while Ethereum rises, Bitrefill study shows

The cryptocurrency market has experienced a short-term crash, but analysts remain bullish for the long-term, foreseeing an upcoming altseason. In this scenario, Bitcoin, Ethereum, and other digital assets compete for market share in crypto payments.

A recent study by Bitrefill, one of the largest crypto-commerce platforms, has revealed a significant shift in users’ payment preferences, giving insights into the demand for these cryptocurrencies.

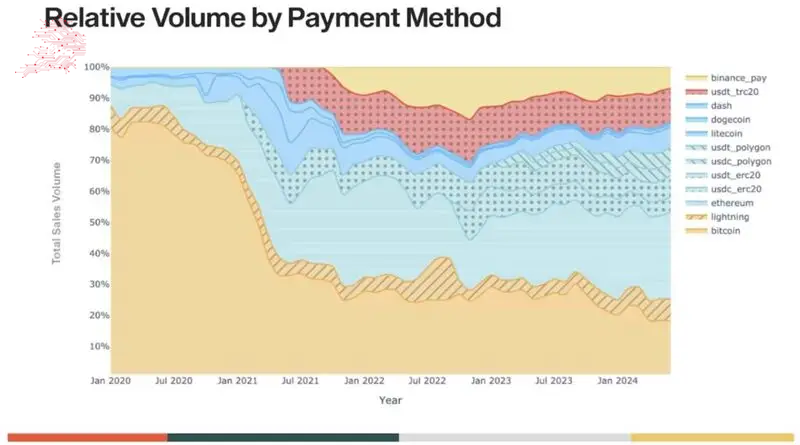

According to the research conducted by Matt Ahlborg and posted on August 27, Bitcoin’s (BTC) dominance in payments on the platform has plummeted by a staggering 55% in relative terms compared to the previous quarter. On that note, data from March shows BTC with a 33.8% dominance, against the 15% current market share.

Picks for you

This significant decline highlights a changing landscape in the crypto payment ecosystem, with alternative cryptocurrencies and stablecoins gaining traction.

Crypto payments: Ethereum ecosystem rises as Bitcoin falters

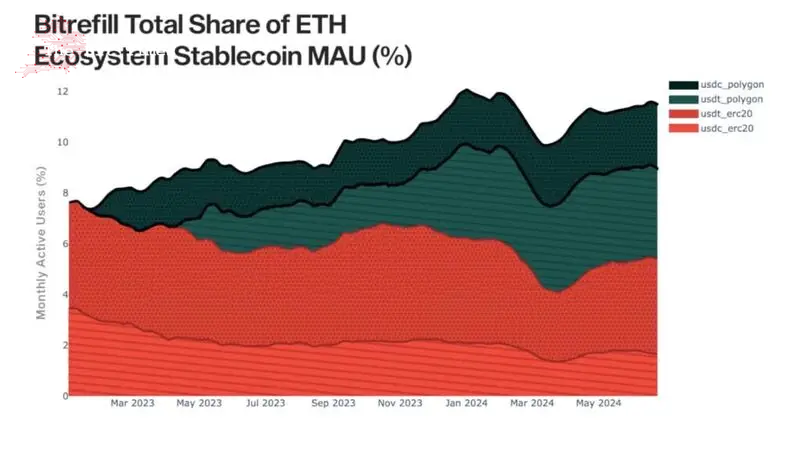

While Bitcoin’s share of payments has decreased, the Ethereum (ETH) ecosystem has seen substantial growth. Ethereum-based users now account for 28% of total users on Bitrefill, boasting the highest average purchase value among customers.

Matt Ahlborg attributes this surge in Ethereum’s popularity to the increasing value returned to the base token from various DeFi projects, ICOs, and NFT ventures.

Interestingly, stablecoins on Ethereum’s layer two solutions, particularly Polygon (MATIC), have outpaced their mainchain counterparts. This shift underscores the growing importance of scalability and lower transaction costs in the crypto payment space.

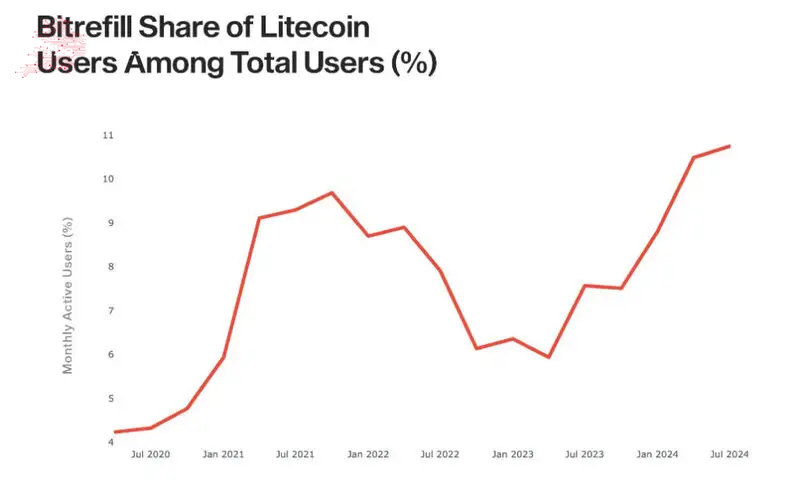

Litecoin, Dogecoin, and Dash payments

The study also points to “Legacy coins” such as Litecoin (LTC), Dogecoin (DOGE), and Dash (DASH) maintaining their popularity. In particular, Litecoin is experiencing a steady uptrend on Bitrefill. According to Ahlborg, these coins have benefited from their widespread availability on exchanges and wallets, serving as effective mediums of exchange.

Moreover, USDT on the TRON network (TRX) has emerged as a major player in the crypto payment landscape. Despite a 350% increase in network fees since early 2023, USDT_TRC20 remains the world’s most preferred crypto payment rail, surpassing both Bitcoin and Ethereum.

However, the fee hike has caused a slight decline in its payment share on Bitrefill, particularly for transactions under $10.

Lightning Network as a BTC alternative

As transaction costs for major cryptocurrencies like Bitcoin, Ethereum, and USDT on TRON consistently exceed $1, users increasingly turn to alternative chains and protocols – some of which are not yet directly supported by the platform.

Therefore, Matt concludes his study by warning of the growing importance of compatibility and interoperability between chains and protocols.

The study also reveals that the Lightning Network has seen an increase in market share as a direct alternative to Bitcoin’s blockchain. Nevertheless, Ahlborg points out that most of these payments are from custodial wallets and usually have remarkably low values.

In conclusion, while Bitcoin’s payment dominance has significantly decreased, the overall crypto payment landscape is becoming more diverse and competitive. As the industry matures, platforms and users will need to adapt to these changing preferences and technological advancements.

Comments

Post a Comment