7 Best Altcoins to Invest in Now May 3 – Immutable, Akash Network, Lido DAO, Core

The cryptocurrency market is still bumpy after the Bitcoin halving, with some coins struggling to bounce back. Bitcoin (BTC) is inching closer to $60,000, hoping to find support for its next big move. Investors need to stay alert during this consolidation phase as it could be a chance to catch a ride on a rising trend.

Institutional investors are now paying more attention to interoperability and tokenizing real-world assets. Prices of these assets are climbing, even before the market fully takes off. The objective is to identify the best altcoins investors can invest in.

7 Best Altcoin to Invest in Now

Regarding upcoming high-value crypto projects, 99Bitcoins is changing the crypto space. The innovative project integrates a “Learn-to-Earn” strategy with blockchain blockchain technology. Users engage in interactive lessons and quizzes to earn $99BTC tokens.

Furthermore, holding $99BTC provides additional benefits, including staking rewards and personalized lessons. Investors also gain access to free trading exposure, signals, and VIP community groups. Below is an overview of 99Bitcoins and the next cryptos to explode.

1. Immutable (IMX)

Immutable enables the development of NFT marketplaces and games. It leverages a shared global order book and a user-friendly NFT wallet experience. The token is transforming NFT trading with its state-of-the-art Features. It provides fast transactions and affordable fees, unlike the Ethereum mainnet.

Meanwhile, Immutable has collaborated with Polygon to launch the “Inevitable Games Fund.” This initiative, totaling $100 million, aims to find and nurture top-notch gaming investment opportunities. This development comes during the unveiling of a $120 million initiative from Starknet. Consequently, this has sparked optimism across the broader Web3 gaming market.

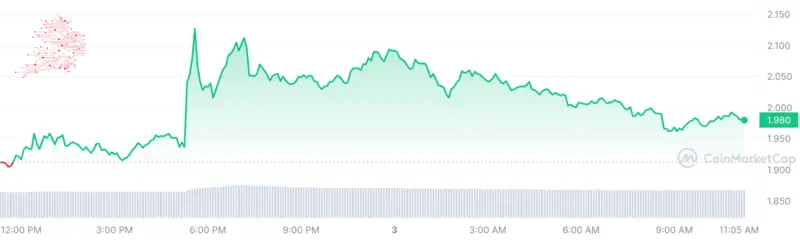

Immutable has seen a big increase in the past year, climbing by over 96%. The cryptocurrency dropped by around 22% in one month, including a 14% decrease in the last seven days. However, as of the time of writing, it had gone up 9.54% in the previous 24 hours.

This is @DESPERADOB218, The Scars of Exos.

With $10.8M raised, the collectible RPG game is launching on Immutable. pic.twitter.com/jnLX6aAyul

— Immutable (@Immutable) April 29, 2024

Despite these recent declines, there are positive signs for IMX. Both its market cap and trading volume are going up, hinting at a potential rise in value soon. Currently, it’s trading between $2.05 and $2.38 per token, boasting a market cap of nearly $3 billion. Analysts predict a surge in its value shortly.

Furthermore, volatility has been low, at around 14% over the last month, showing stability. Moreover, liquidity is high, with a healthy volume-to-market cap ratio of 0.0361. This cap ratio indicates there is enough trading activity to support further growth.

2. Axelar (AXL)

Axelar distinguishes itself by facilitating secure cross-chain communication over dynamic validators. The token utilizes PoS, which is a rarity in the space. It fosters cross-chain transfers via wrapped ERC-20 versions, enhancing interoperability across blockchain networks.

Furthermore, its developer-centric strategy shortens users’ learning curves. This strategy enables developers to work on familiar chains without losing interoperability. Its simple API streamlines development, promoting innovation across blockchain ecosystems.

Meanwhile, the token experienced a notable surge in the last 24 hours, with Axelar’s price experiencing a 1.28% increase. Currently trading at $1.23, it stands 146.79% above the 200-day SMA of $0.477891. This SMA signifies bullish sentiment around the token. AXL boosts a 14-day Relative Strength Index of 54.13. This RSI reflects a neutral stance and suggests potential sideways movement.

💎 GM Gem Seekers. Good news: Axelar powers bridging into @Immutable from Ethereum today! https://t.co/trJgHjA8PB

— Axelar Network (@axelarnetwork) May 2, 2024

Despite a modest 37% green days ratio in the previous month, Axelar exhibits relatively low volatility at 19%. High liquidity is evident, with a volume-to-market cap ratio of 0.1285, reflecting robust market participation.

3.Core (CORE)

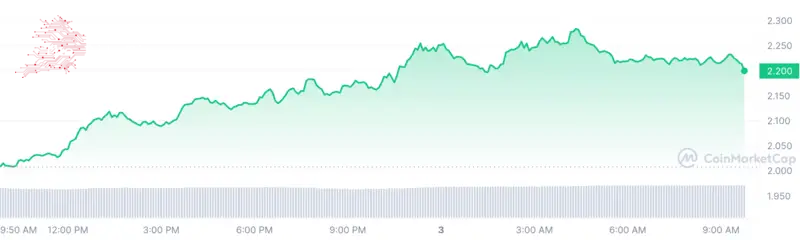

CORE is a leading player in the decentralized finance (DeFi) sector. The platform strives to offer a robust platform for financial activities and innovative products without traditional financial intermediaries. The token continues to experience a consistent value surge by building on its impressive leap of over 30% last month.

Despite the general market experiencing a brief decline, Core consistently posted remarkable price movement this week. If it maintains its current momentum, the token could become one of the most profitable investments as the new quarter begins and beyond.

CORE stands out as a top performer this week reaching around $2. Starting the week around $1.1, it steadily rose to $1.99 today. By midweek, it settled at around $1.7. This rise is nearly a 72% increase from the start of the week.

The Core Chain x @eddy_protocol Campaign is Ending Soon! 🔶🔥

Complete the tasks & claim your rewards! 😎🎉

Join Now: https://t.co/o555FG97nZ https://t.co/zGXu8J2ntf

— Core DAO India 🇮🇳 (@CoreDAOIndia) May 3, 2024

Further Analysis shows that CORE is trading at a 3.76% increase at the time of writing, with its market value exceeding $1.9 billion. As the month rolls on, analysts predict a significant surge, which will see the token become the most valuable token in May.

Considering how CORE maintains support at $1.9 and moves forward suggests another major rally is imminent. If the upward trend continues and Bitcoin remains favorable, the next target is $4.1. Some investors have previously gained profits of up to 640%.

4. Akash Network (AKT)

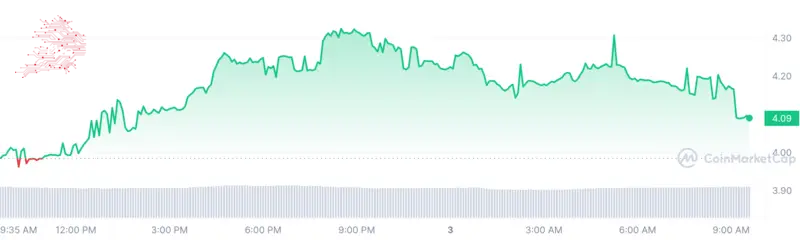

Akash Network has experienced notable developments recently. On March 18, AKT began trading on Coinbase. Furthermore, last week, Akash deployed Llama 3 70B on its network. The project described this model as “the most capable openly available AI model.” it also uploaded its protocol on Mainnet earlier today.

Consequently, Akash Network responded positively to these developments, posting a 4% gain within the last 24 hours. The token trades at $4.09, a 1515.6% YTD surge. This increase happened alongside a massive spike in trading volume, which rose by 1,500% to $74.9 million.

The AKT cryptocurrency initially rose by over 6% to $4.4. During this rise, the token converted its significant historical resistance at $4.8 into a strong support level, currently preventing a decrease. The increase in AKT’s value coincided with Upbit announcing the listing of the AKT token, generating significant trading activity and investor interest.

Akash Network’s price surge occurred suddenly, with the token rising from $3.0082 to $4.4. This rapid increase led to a price correction, stabilizing AKT around the $4.09 support level. However, some analysts believe further correction could return the token to previous levels.

Akash provides permissionless access to a wide range of compute resources at extremely competitive pricing.

As the general awareness of Akash grows, there are many emerging dynamics that uniquely position the network to bring compute resources to market and serve users around… https://t.co/1dL9SrUDqU

— Akash Network (@akashnet_) April 30, 2024

Traders are now examining technical indicators and signals to predict AKT’s future price movements. For instance, the token’s Relative Strength Index (RSI) reached an exceptionally high value of 97.77, indicating overbought conditions. Subsequently, the RSI decreased to 72.95 as of now.

While the declining RSI suggests profit-taking among traders, the wide Bollinger bands present a bullish signal. Traders may opt to buy AKT at its dip, potentially driving its price back up or maintaining it above $4.

5. Lido DAO (LDO)

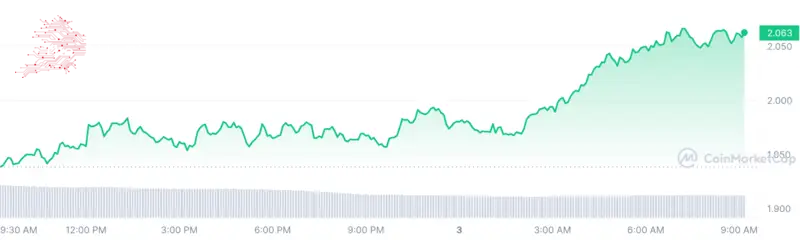

Lido DAO experienced significant growth over the weekend and still holds onto some gains. Currently priced at around $2.13, it has risen by nearly 2.5%, with buyers striving to maintain the gains achieved as the token reached $2.21. If the upward trend continues, LDO/USD could target a retest of the $2.50 mark.

Lido DAO is a decentralized autonomous organization (DAO) that offers staking infrastructure across various blockchain networks. Its primary service allows users to stake Ethereum, receiving stETH tokens in return, representing their staked ETH and the rewards earned.

Lido DAO prioritizes security through decentralized governance, audited code, and smart contracts based on Ethereum. These measures facilitate the process of user deposits and the distribution of rewards.

Lido DAO also aims to make staking accessible by combining ETH from various users. This removes the requirement for specialized knowledge or a minimum staking amount of 32 ETH. Through Lido Liquid Staking V2, users can participate in more effective and flexible staking for Ethereum 2.0.

Stake assets directly from your DAO or multisig on @LidoFinance 💧

Use the Aragon App's new dApp Connect feature to pass a proposal and start staking.

Follow these three simple steps 👇 pic.twitter.com/9IZgeoWqaO

— Aragon 🦅 (@AragonProject) May 2, 2024

An important feature is its “Liquid Staking” approach, which allows users to swap ETH for stETH tokens. This increases liquidity and enables involvement in LSDFi protocols.

Despite experiencing 40% positive trading days in the previous month, LDO’s volatility over 30 days remains low at 15%. Alongside stability, the crypto maintains high liquidity. These factors indicate strong trading activity and investor interest.

6. 99Bitcoins (99BTC)

99Bitcoins launched its cryptocurrency, the 99Bitcoins token (99BTC). The token rapidly raised over $790k hours into its presale. This development demonstrates the tokens’ potential. Moreover, investors still have the opportunity to purchase tokens at the initial price of $0.00102, although rates are expected to increase over time gradually.

Moreover, a presale limit of $10.3 million incentivizes investors to acquire discounted 99BTC tokens before the price increases. These tokens fuel the Learn-to-Earn platform, where users are rewarded for learning about cryptocurrencies. As funding milestones are achieved, the price of 99BTC gradually increases.

Furthermore, the innovative Learn-to-Earn concept incentivizes users to educate themselves about cryptocurrency, providing benefits to token holders. Also, 99Bitcoins intends to enhance the learning experience by gamifying Bitcoin education. Users who complete challenges and lessons earn higher rankings and $99BTC tokens as rewards.

🚀 Ready to stake your $99BTC and unlock passive rewards? ⭐️

Visit our website, connect your wallet, and start staking to earn rewards. It's that simple.

Learn more: https://t.co/NXD7DAamqr#99BTC #BTC #MetaMask #ETH pic.twitter.com/k2a3Q5ab6R

— 99Bitcoins (@99BitcoinsHQ) May 3, 2024

Conversely, the project explores the potential effect of Bitcoin halving events and has attracted a broad audience across various platforms. The token distribution allocates 10.5% for presale, 14% for staking rewards, and portions for development, community rewards, liquidity, and marketing.

Subsequently, the token has launched a giveaway on its platform. Participants can win free Bitcoin from a $99,999 BTC prize pool, with over 4,000 entries. Also, token holders participating in the presale can benefit from holding 99Bitcoins tokens.

Visit 99Bitcoins Presale

7. Beam (BEAM)

Beam has continued its dizzy price movement from April. The token drew significant interest due to its consistent price climb throughout April. The positivity surrounding the Bitcoin-halving event has rubbed off on Beam—the token trades at $0.02468, reflecting a 6.71% increase in the last 24 hours.

Furthermore, investors are bullish on Beam, as demonstrated by its Greed score, which is at 78. The token’s increasing trading activities fuel this bullish sentiment. These strong fundamentals suggest a favorable outlook for the token, indicating Beam’s ability to attract ongoing investor interest and achieve substantial market expansion.

Moreover, Beam has exhibited remarkable market growth over the past year, with an impressive 277% increase. Also, it has outperformed 76% of the top 100 cryptocurrencies, including Bitcoin and Ethereum. Beam trades 332.26% higher than the 200-day SMA, which is $0.004690. This strong performance underscores the token’s potential as an investment opportunity in cryptocurrency.

We told you more games are coming!

Welcome to the @BuildOnBeam family @gingerjoygames 🥖 🕹️ https://t.co/sj6SCmcpCI

— Merit Circle (@MeritCircle_IO) May 2, 2024

Meanwhile, analysts predict that if Beam partners with other networks, it could reach $0.1. In a bullish market, the average price could stabilize around $0.08 before May ends. Conversely, in a market downturn, it could nosedive to $0.01.

Learn More

- Best Cheap Crypto

- Our Previous Best Cheap Crypto to Buy Now Post

Comments

Post a Comment